Common Sales Cycles Based on Industry

It is important to know the general sales cycles on an industry basis so that proper forecasting, resource planning, and aligning common sales cycles based on industry strategy with the forecasted timelines can be done. The length of the sales cycle differs greatly across industries, and it depends on the decision-making framework, product complexity, regulatory limits, and level of deals.

As companies refine their go-to-market motions in 2026, it is important to analyze credible benchmarks to ensure teams set realistic expectations and optimize pipeline velocity.

Harvard-level data shows that sales cycles have been extended overall in recent years, especially in complex B2B settings. For example, 58% of B2B professionals in 2025 indicated that the sales cycles were longer than the prior year, as an indication of more deliberative purchasing actions.

Sales Cycle Benchmarks: How Long Do Deals Really Take?

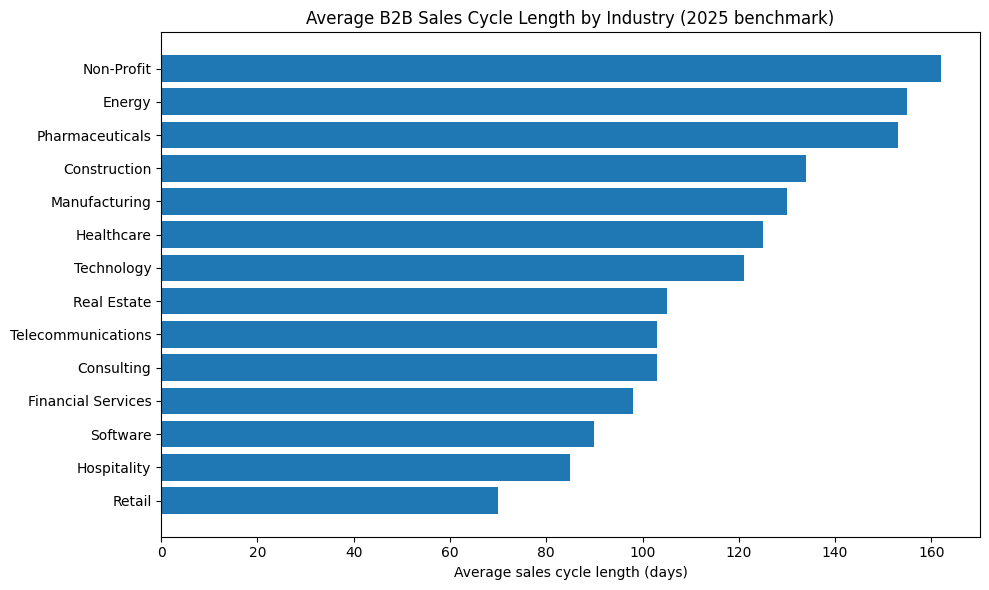

The length of the sales cycle is not universal. Based on the recent aggregated industry benchmarks:

- The average retail transactions take approximately 70 days to complete after the initial contact, one of the shortest in the B2B segments.

- Software and Technology industries see around 90-110 days, as a reflection of the subscription services and decision committees.

- The process for Healthcare and Pharmaceuticals typically takes 125-153 days on average, as it involves regulatory compliance and multi-stakeholder approvals.

- The manufacturing and capital equipment sales have an average of about 130 days, which are affected by the complexity of supply chains and the budget cycles.

These standards indicate the influence of industry factors on the time taken to turn interest into revenue. The shorter turnaroundinf retail is due to fewer purchasing decisions and fewer tiers of approval, whereas industries with regulatory restrictions or high capital requirements face longer turnaround times.

Sales Cycles in B2B Context: Median Benchmarks

As we consider B2B environments more narrowly, large deal sizes and decision-making processes further extend sales cycle benchmarks. According to implicit data analyzed by Geckoboard, the average lead-to-close sales cycle in B2B is 102 days, the lead-to-opportunity stage is 84 days, and the opportunity-to-close stage is 18 days.

This global median across B2B deals underscores how most enterprise and mid-market sales require sustained engagement, meticulous qualification, and multiple touchpoints before closing.

Breakdown by Key Industry Segments

In the technology and SaaS sectors, sales cycles vary considerably based on customer segment:

- Smaller subscription products may be closed within 14-30 days, where digital contracts and reduced friction are likely to work in favor of SMB SaaS deals.

- Mid-market interactions take 30-90 days when buyers need technical demonstrations and integration reviews.

- Enterprise software deals frequently stretch to 90–180+ days, especially where customization, compliance, or multi-region approval is needed.

All in all, median tech cycles can be shortened with streamlined sales procedures, though complexity and personalization tend to drag the schedule longer.

These standards indicate that, even among market participants in a single industry, cycle time is highly dependent on customer segments and the size of transactions.

Manufacturing & Industrial Goods

The manufacturing business has some of the longest B2B sales cycles because of the capital expenditure needs and complicated procurement. Most recent benchmarking shows manufacturing transactions of an average of 110 days or longer, with equipment lines occasionally going beyond the 110 days because of testing, financing authorizations, and supply complexity.

In a high-value business such as industrial machine manufacturing, purchasers frequently involve design, engineering, and purchasing departments, prolonging the negotiation and appraisal periods. Such real-world situations imply that sales executives should have longer horizons and design sales motions.

Healthcare & Life Sciences

Healthcare and pharmaceuticals are good examples of industries in which regulated environments and clinical validation have extended sales cycles tremendously. By 2026, the average cycle in the healthcare industry will be between 125 days for general healthcare solutions and 153 days in the pharmaceutical industry, based on the regulatory approvals and compliance reviews.

Technical evaluations, trials, and approval by stakeholders are also part of medical device procurement, and this increases the timeframe. These cycles are also an indication of product complexity and a risk-averse attitude of healthcare purchasers.

Financial Services, Consulting & Real Estate

Financial services and advising businesses tend to have a median length of industry sales cycles data, which means that there is preparation in the procurement process, but regulatory problems are less than those in life sciences:

- A financial service transaction takes an average of 98 days in compliance checks and fiscal review.

- The average consulting and professional services of over 100 days are usually fuelled by proposal creation and layers of stakeholder evaluation.

- Real estate transactions, particularly commercial deals, average around 105 days, impacted by due diligence, financing, and legal processes.

Source: Image by freepik

Factors That Significantly Impact Sales Cycle Duration

The deal size is associated with the cycle length across industries. Bigger contracts have more stakeholders, formal approvals, and custom negotiations, and last longer. For example, transactional deals below 10,000 are usually closed within weeks, whereas enterprise or high-ACV deals may take several months or a year to close.

Regulatory & Technical Evaluations

Industries such as healthcare and energy need compliance evaluation and cross-departmental reviews, which overstretch the deadlines to a new level. Equally, technologies that involve integration tests or configuration by themselves are slow in making final decisions.

Decision-Making Structure

The more decision-makers are involved, the longer the sales cycles. B2B companies, particularly in middle market and enterprise divisions, need the approval of all departments, legal, finance, and operations, before deals are made. This trend is involved in longer sales cycles than consumer sales.

Why Understanding Cycle Benchmarks Matters

Understanding typical sales cycles by industry will allow sales leaders to make improved predictions, deploy resources, and monitor performance. Benchmarking to reliable industry data helps companies to increase the accuracy in their pipeline and detect potential bottlenecks in the cycle to implement specific improvements in the process.

For example, the management of a technology company can examine the average cycles by industry standards (i.e., 130+ days vs. a standard of 90-110 days) to perform an investigation and management of causes.

Leveraging Automation & Data Tools to Improve Sales Cycle Accuracy

With the increased complexity of sales processes, automation and data platform systems become important to reduce timelines and enhance efficiency. Smart automation and analytics are helpful in assisting teams:

- Predict pipeline velocity using historical patterns.

- Automate routine follow-ups to maintain engagement without manual overhead.

- Signals on the surface and give priority to opportunities that are most likely to close.

Studies indicate that companies that apply combined data analytics and AI support in their sales activities increase the quota attainment rates, and half of sales professionals note that their performance is improved since they use CRM and automation tools, which is the effect of technology on improving the efficiency of the cycle.

Automation platforms can particularly benefit resource-limited teams by scaling lead engagement and data processing - enabling sales teams to focus on high-value interactions that move deals forward efficiently.

Conclusion

Credible sources indicate that sales cycles are becoming longer across most industries as customers require more information and evaluation time, underscoring the importance of advanced sales motions and analytics.

The knowledge of common sales cycles based on industry benchmarks has enabled the leaders in sales to customize their style, be it to reduce transaction time or to navigate through complex enterprise deals and help set expectations with the reality of current-day sales dynamics.

With the help of automation and data-driven platforms, teams can gain visibility, reduce delays, and drive consistent revenue outcomes across industries.